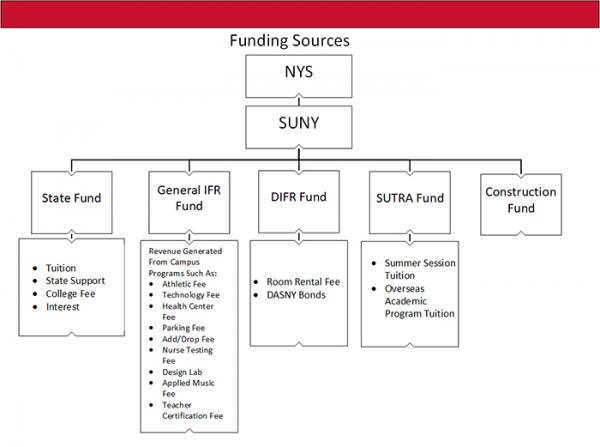

SUNY Potsdam engages in several revenue generating activities. Revenues from tuition are the college’s primary form of financial support, but many other revenue streams play an important role in enabling Potsdam to fulfill its mission in a more meaningful way. The source of the revenue determines where the revenue is required to be deposited and managed.

Each funding source has its own set of accounting and fiscal controls. Following is a brief description of the primary aspects of each funding source. The fiscal year for each funding source is the same — July 1 through June 30.

The following document will cover the following topic areas:

- NYS & SUNY Budget Process Overview

- Campus Financial Resources Overview

- Account Management

- Budget Mechanics

Fund into which tuition, state support, interest, and the college fee are deposited for spending as part of financial plan submitted to SUNY. Considered the college’s core operating budget. The state Legislature through the state budgetary process appropriates state tax support funds annually. All activity is monitored by the state Comptroller’s Office.

State construction funds are appropriated annually by the state Legislature through the state budgetary process specifically for construction projects. Construction funds can not be used for operational expenditures. All activity is monitored by the state Comptroller’s Office.

Self-supported fund dedicated to residence hall operations and funded from room rental fees and charges.

Fund dedicated to campus operations and funded from tuition revenue collected from summer session, contract courses, overseas academic programs and excess tuition revenue from the core operations budget.

SUNY policy provides for the establishment of IFR accounts which are self-supporting accounts that support activities related to the college’s mission. IFR accounts are deemed self-sufficient when they operate on a break-even or better basis including the costs of assessed overhead expenses. IFR expenditure budget authority is appropriated annually by the state Legislature and all payments are subject to the college’s purchasing and contracting guideline and are approved by the state Comptroller’s Office.

IFR accounts have clear and defined income/expenditure relationships. Each IFR account must generate revenue sufficient to cover costs incurred and be managed to a positive cash position. Account managers are responsible for monitoring account activity and maintaining financial controls.

There are four types of Income Fund Reimbursable accounts.

- Campus broad-based fees and miscellaneous course fees

- Fee-for-service programs such as parking, add/drop fees, testing center fees, etc.

- Facility use fees

- Funded reserves necessary for long-term financial stability of the college.